Council Tax bill explained

To help you understand your bill this page will help explain what each section means.

1. The names of the persons who are liable for Council Tax. View information on who is liable for Council Tax.

2. The address the bill has been issued to. In most cases this is also the address that the bill is for. But, if the bill is for a different address it will state this below.

3. This is the date the bill has been issued. Council Tax bills are posted 2nd class or sent by email.

4. This is your unique Council Tax account reference number. If you need to contact us, or pay your bill, you will require this number.

5. The Valuation Office Agency allocates your property a band. The amount you pay, will depend what band your property has been allocated. View more information on Council Tax banding.

6. If your property qualifies for a Disabled Band Reduction it will show here. View more information on Disabled Band Reduction.

7. The online key is a unique code on each bill that gives you access to your account online - My Council Tax - view information about how to access your My Council Tax account.

8. The address for which the Council Tax bill is for, if different from the address above in point 2.

The barcode which was previously on the front of your bill, is now shown on the reverse. This will be required if you wish to pay your bill at a PayPoint or Post Office outlet.

9. The period for which your Council Tax bill relates to, alongside the total charge.

10. Here you will find details of any adjustments, such as a discount or exemption.

11. At the date the bill was issued this details the payments received towards your bill. Details of any Council Tax Reduction award and payments made on your account are detailed on separate lines.

12. The amount of the charge you have left to pay by 31 March. This is your overall account balance which is the total amount owing for all financial years.

13. Your payment method, instalment dates and the amounts due. If it states Direct Debit, instalments will be taken automatically from your bank account. It will show here any due amounts that are immediately payable from the previous bill.

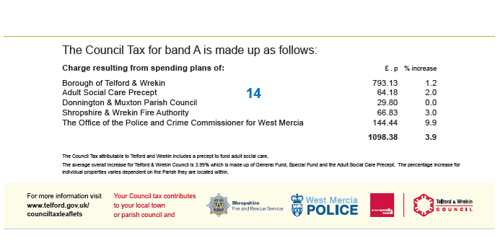

14. This section details how the Council tax charge is split between the Council and charges for other organisations that we collect on their behalf. These are Shropshire and Wrekin Fire Authority, The Office of the Police and Crime Commissioner for West Mercia and since 1 April 2016 Adult Social Care - view information about the Adult Social Care Precept. They are added together and form the total annual charge for the property. It also details the annual percentage increase for each individual charge.

14. This section details how the Council tax charge is split between the Council and charges for other organisations that we collect on their behalf. These are Shropshire and Wrekin Fire Authority, The Office of the Police and Crime Commissioner for West Mercia and since 1 April 2016 Adult Social Care - view information about the Adult Social Care Precept. They are added together and form the total annual charge for the property. It also details the annual percentage increase for each individual charge.

Related Council Tax services and forms:

- view information on how to report a change in your circumstances

- view information on how to notify us you’ve moved into a newly built property

- view information about how to apply for a Council Tax discount/exemption if your property is empty

- view information about how to apply for a Council Tax discount/exemption for occupied properties

- view information on how to register for e-billing

- view information on how to sign up to pay your Council Tax by Direct Debit

- view information on how to pay your Council Tax online

- complete our online form to request a refund on your Council Tax account.

Last updated : 17 July 2025