From 14 November 2018, most working age customers will need to claim Universal Credit for help with their rent. If you have a change of circumstances that ends your current Housing Benefit entitlement (for example, an increase in income) and you need to make a new claim in the future, you will usually have to make a claim for Universal Credit for help with your rent. View information about the eligibility for Housing benefit to see if you are eligible.

Visit the GOV.UK website for more information about Universal Credit and how to claim it.

Universal Credit will not cover Council Tax. View information about how to claim Council Tax Reduction if you need help to pay your Council Tax.

Tell us straight away if your circumstances change.

Your Housing Benefit and Council Tax Reduction (formerly known as Council Tax Support) is worked-out using the information you give us on your application form.

If this information has changed, you may no longer be getting the right amount of help towards your rent or Council Tax.

Changes you need to tell us about

Examples of some of the changes you need to tell us about are:

- changes to you or your partner’s income (including benefits)

- changes to you or your partner’s savings, including if you inherit money/property

- if you or your partner start or leave work

- changes in your or your partner’s working hours, hourly rate/salary or employer

- if you are moving home

- changes to your rent

- someone else moving into or out of your home

- the birth of a child

- your children leaving school or starting work

- the changed circumstances of anyone living with you

- any period of temporary absence from your home of 4 weeks or more.

If you’re entitled to more benefit because of a change, you will normally only be awarded the extra benefit from the time that you tell us. We won’t be able to backdate it.

If you’re entitled to less benefit because of a change, your benefit will reduce from the date the change occurred. If you’ve been overpaid, we will ask for the money back.

If you don’t tell us about a change that affects the amount of Council Tax Reduction you receive, even if it wasn't deliberate, we may fine you £70 as a penalty.

If you deliberately don’t tell us about a change, we or the Department for Work and Pensions may investigate you for benefit fraud and prosecute you if you are found guilty.

Find out how we respond to benefit fraud and how to report it to us

Online forms

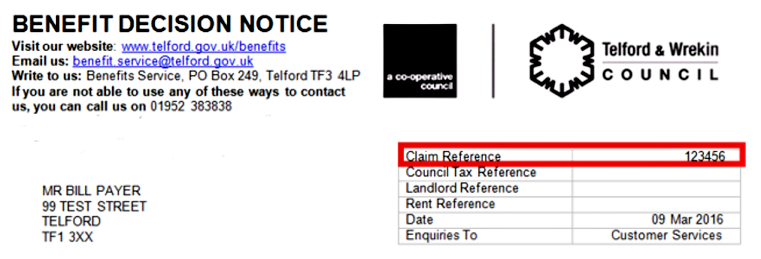

The fastest way to update your claim is to report your change online using the appropriate online form. To do this, you will need to have your claim reference number handy. This number can be found on your benefit award letters in the top right-hand corner:

If you don’t know your claim reference number, please make sure you give us your full name, address and postcode so that we can find your claim.

Complete our online form to report a change of address

Complete our online form to report a change in circumstances

Last updated: 01/06/2022 18:11

Libraries on Facebook

Libraries on Facebook Libraries on Twitter

Libraries on Twitter