How can I make a new claim for Housing Benefit and/or Council Tax Reduction?

Housing Benefit

Visit the GOV.UK website to check whether you may be entitled by using the benefits calculators. Most working age customers will need to claim Universal Credit for help with their housing costs.

If you qualify for some Housing Benefit entitlement, use our online form to start your claim and book a telephone appointment with a Benefits Assessor to complete it. Any entitlement to Council Tax Reduction will also be calculated at the same time.

View information on how to submit a claim for Housing Benefit

Council Tax Reduction

Visit the GOV.UK website to check whether you may be entitled to Council Tax Reduction by using the benefits calculators. View information on the amount of Council Tax Reduction discount you may receive if you are working age by referring to our Income Grid.

If you qualify for some Council Tax Reduction, use one of our online forms to start your claim. There are different forms, depending on whether or not you are claiming Universal Credit.

View information on how to submit a claim for Council Tax Reduction

When will my claim start?

The date your claim will start depends on how and when you made your claim for Housing Benefit and/or Council Tax Reduction.

We normally start your Housing Benefit or pension age Council Tax Reduction claim from the Monday after you first made contact with either us or the Department for Work and Pensions (DWP), but only if you complete the claim process within one month. If you don't complete the claim process within one month, your claim will usually start from the Monday after we receive your completed claim.

It is therefore very important that you contact us as soon as you want to claim and that you are available for any appointments that we make for you.

Council Tax Reduction for working age customers will usually start on the date you make your claim.

Can you start my claim from an earlier date?

We cannot usually start your claim any sooner than the Monday after you first contacted us.

View information on when your claim will start

However, in certain circumstances, we may be able to backdate your claim for up to a maximum of one month for Housing Benefit or three months for Council Tax Reduction from the date you make your backdate request. To be considered for this, you must:

- make a written request for backdating

- tell us the date you want to claim from

- if your income was any different during the backdate period, provide evidence of it

- for Housing Benefit, you will also need to tell us why you didn't make your claim earlier. Please give us as much information as you can in support of your request as we have to decide whether you have good cause for not making your claim sooner.

We will then look at your request and decide whether your claim can be started from an earlier date.

When will I receive my next Housing Benefit payment?

Housing Benefit is paid in arrears. You will receive a payment at the end of every four weeks or, if your rent is charged monthly, on the 1st of every month. If the 1st of the month falls on a weekend or a bank holiday, we will make the payment early so that it reaches you in time for the 1st.

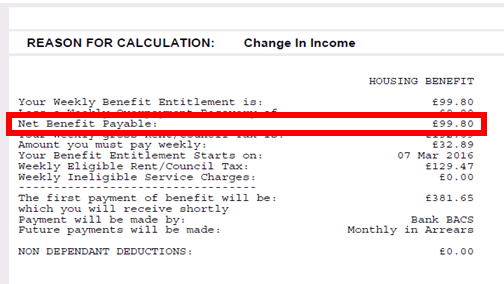

All payments are made by BACS, so you will need a bank account. Your payment frequency is shown on your award letter.

Below is an example award letter, showing the frequency of when future payments will be made.

If you are a Council Tax payer, you can view your Housing Benefit and Council Tax Reduction entitlement online, including the date of your last payment, the amount and the payee, by signing up for an online account.

How much will my Housing Benefit and Council Tax Reduction be?

The amount of Housing Benefit you receive is shown on your benefit award notification letter as a weekly amount.

View information about benefit award notification letters

The amount you receive might be different from your weekly entitlement. For example, we might deduct an amount if you are repaying an overpayment.

Below is an example of an award letter, showing the net benefit payable.

The amount of any Council Tax Reduction you are entitled to is shown on your Council Tax bill.

If you are a Council Tax payer, you can view your Housing Benefit and Council Tax Reduction entitlement online, including the date of your last payment, the amount and the payee, by signing up for an online account.

How much rent do I have to pay?

We cannot tell you how much rent you need to pay as we do not know if you have to pay your landlord anything that isn't covered by Housing Benefit, for example payments towards rent arrears.

If you are unsure how much rent you need to pay, you will need to contact your landlord.

Why are you making Housing Benefit payments to me and not my landlord?

If you are the tenant of a private landlord, the rules about Local Housing Allowances say that we must pay Housing Benefit direct to you. In limited cases, we may consider paying your landlord instead, but only if you satisfy certain criteria. Some examples of these criteria are:

- you have a previous history of consistent non-payment of rent

- you have severe debt problems, such as mortgage possession proceedings

- you have a learning disability that makes it hard to manage finances

- you have serious difficulties with reading and writing

- you have a medical condition, such as mental health problems, that may affect your ability to manage your finances

- you have addiction problems, such as drugs, alcohol or gambling

- you are fleeing domestic violence, other violence or harassment

- you've recently been released from prison.

This list is not exhaustive.

If you think you satisfy any of these criteria, please email the Benefits team at benefit.service@telford.gov.uk and provide us with more details. We may ask you for proof of your circumstances.

If we are made aware that you have rent arrears of 8 weeks or more, we will make payments direct to your landlord.

If you are the tenant of a housing association or other social landlord, you can usually choose whether we pay you or your landlord.

If I start work, take on more work or my partner moves in, will I still qualify for Housing Benefit and/or Council Tax Reduction?

Visit GOV.UK website to use the benefits calculators to estimate the Housing Benefit and/or Council Tax Reduction you may be entitled to. You can do this as many times as you like, so you can see how different changes in your circumstances will affect your entitlement.

If you are of working age, view information on the amount of Council Tax Reduction discount you may receive by referring to our Income Grid.

Why has the amount of my Housing Benefit and/or Council Tax Reduction changed?

The amount that you are entitled to may have changed if you have had a change in your circumstances, such as you or your partner's income going up or down, if you start receiving a new income, or if someone moves in or out of your household.

The Department for Work and Pensions (DWP) and HMRC sometimes sends us information about changes to your income. We also receive data matches from other Government bodies that could show that the information we hold for you is different to information that they hold.

Please remember, it is your responsibility to report any changes to us when they happen. The fastest way to tell us about a change is to use our online form and upload your evidence of the change at the same time.

Complete our online form to report a change in your circumstances to us

If you don't tell us about a change that leads to you being paid too much Housing Benefit and/or Council Tax Reduction, you may receive a financial penalty (fine). You may also be investigated by the Council and/or DWP Investigation Teams.

Why are you making deductions from my Housing Benefit?

There are two reasons why we might be making a deduction from your Housing Benefit.

Firstly, we might be making a deduction for a non-dependant.

Non-dependants are other adults living in your home, for example, a friend or members of the family - like grown-up children or parents. The government says we must make a deduction for any non-dependants living with you. The amount of the deduction depends on the non-dependant's income.

Secondly, we might be recovering an overpayment.

If you have had a change in your circumstances that means we've paid you too much Housing Benefit, we call this an overpayment. After the change, if you're still entitled to Housing Benefit, we will recover the overpayment from your ongoing entitlement until you have paid it back in full.

What can I do if I think my entitlement is wrong?

If you've had a change in your circumstances since you made your original claim, this may affect the amount of Housing Benefit and/or Council Tax Reduction you're entitled to. You must report a change in your circumstances as soon as possible. The fastest way to tell us about a change is to use our online form.

Complete our online form to report a change in your circumstances to us

If you think we've made a mistake, please tell us straight away by emailing the Benefits team at benefit.service@telford.gov.uk.

If you want to know more about a decision, want us to look at your claim again or you want to formally appeal against a decision we've made, please download our Housing Benefit and Council Tax Reduction dispute form. You must do this within one month of us making the decision.

View information on how to dispute a Housing Benefit decision

View information on how to dispute a Council Tax Reduction appeals page

Why do I still have to pay Council Tax when I'm receiving a benefit?

From April 2013, all working age people (except some severely-disabled residents receiving certain means-tested benefits) who live in the borough have had to pay something towards their Council Tax.

From April 2020, all working age people have had to pay something towards their Council Tax under the Council Tax Reduction scheme.

This is currently set at a minimum of 10% of the charge but depends on the income of the customer and any partner.

View information about Council Tax Reduction discounts

The easiest way to pay your Council Tax is by direct debit; you can even pay weekly.

View information about the Council Tax payment options available

Why have you sent me a form when I'm already getting Housing Benefit and/or Council Tax Reduction?

From time to time, we may review your claim to make sure our information is up-to-date. The Department for Work and Pensions (DWP) may also ask us to review your claim if there is a high chance that you may have had a change of circumstance.

We will send you a Benefit Review form and ask you to return it with evidence of your income. If we hold an email address for you, we will send you an email with a link to an online form. If we hold a mobile telephone number for you, we will send you a text message. If we don’t hold an email address for you, a review form will be sent to you in the post.

It is important that you return the form with your evidence as soon as possible. If you don't return the form, we can suspend your payments. If we don't hear from you, we can cancel your claim and end your award. If you are of working age and your Housing Benefit claim ends, you will usually need to claim Universal Credit if you want help with your housing costs.

Please remember, it is your responsibility to report any changes to us when they happen. The fastest way to tell us about a change is to use our online form.

Complete our online form to report a change in your circumstances to us

If you don't tell us about a change that leads to you being paid too much Housing Benefit or Council Tax Reduction, you may receive a financial penalty (fine). You may also be investigated by the Council and/or DWP Investigation Teams.

How can I send you information?

The quickest and easiest way to send us information if you are receiving Housing Benefit and/or Council Tax Reduction - and have had a change in your circumstances or address - is to use one of our online forms. You can upload evidence of the change at the same time (for example, a photograph of your payslip, etc.).

Find out more about our change of circumstances online forms

If you haven't had a change but need to send us information, for example, that we have requested, you can email the Benefits team at benefit.service@telford.gov.uk.

If you can't email us, you can post information or documents to us at:

Benefit Service

Telford & Wrekin Council

PO Box 249

Telford

TF3 4LP

I am a landlord. Why haven't you sent me a payment schedule showing me the Housing Benefit payments I receive from my tenants?

We stopped sending out paper payment schedules in the post from April 2016. You can request access to our online Landlord Portal, where you can view real time information about your tenants' Housing Benefit awards (for cases that are paid to you) and the payments we have made or are due to make.

You can also download details of payments in Excel format and see these before the money has even reached your account, quicker than waiting for the post to arrive.

Complete our online form to request access to the Landlord Portal

Once completed, we will then register your details and within 10 working days email you your personal user ID, temporary password and a link to the portal, together with a user guide.

Last updated: 01/06/2022 18:00

Libraries on Facebook

Libraries on Facebook Libraries on Twitter

Libraries on Twitter